If you are looking for a reliable proprietary trading firm that focuses on Forex, CFDs, and commodities, Breakthrough Capital might be a good option to consider.

This review covers everything you need to know about the firm — including its trading programs, profit share, leverage, and rules — in a simple and easy-to-read format.

About Breakthrough Capital

Breakthrough Capital is a proprietary trading firm founded by experienced traders.

The firm’s mission is to give traders access to simulated trading capital in a transparent and professional environment.

It provides a platform where traders can showcase their skills, earn a share of profits, and grow without risking their own money.

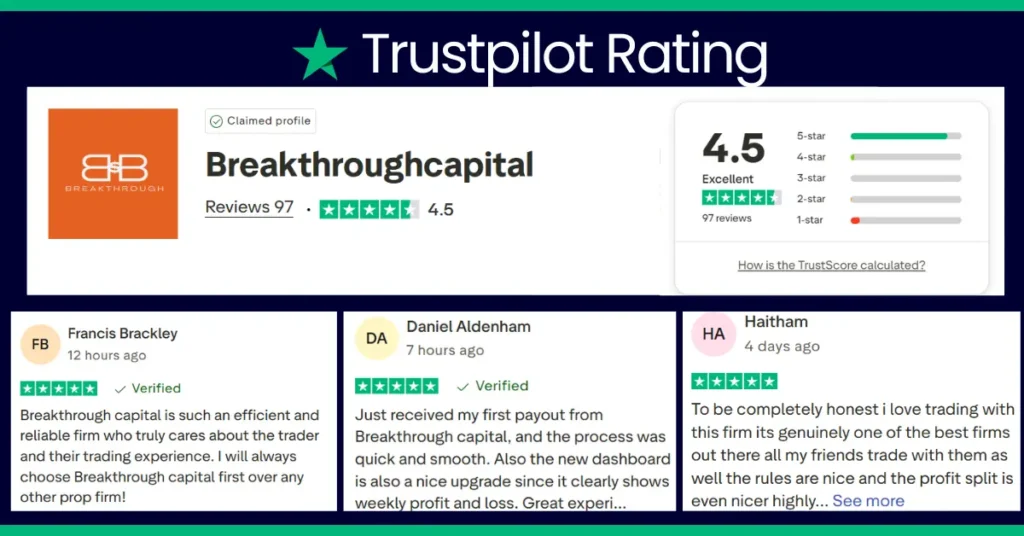

Trustpilot Rating And Customer Review

Trading Instruments

Breakthrough Capital supports trading in a wide range of markets, including:

- Forex pairs (major, minor, and exotic)

- CFD indices

- Commodities such as gold, silver, and oil

This variety allows traders to diversify and explore different market opportunities.

EA (Expert Advisor) Policy

The firm has a strict policy against the use of Expert Advisors (EAs) or automated trading systems.

All trades must be executed manually, ensuring that results are based on skill and decision-making rather than automation.

Profit Share Structure

Breakthrough Capital offers a competitive profit-sharing model, allowing traders to retain most of their earnings.

- Standard Profit Split: 90% (to the trader)

- Optional 100% Profit Split: Available with an extra 20% fee on the challenge price

- Maximum Payout per Cycle: 10%

Leverage Offered

The firm provides moderate and responsible leverage limits:

| Asset Type | Leverage |

|---|---|

| Forex | 1:50 |

| Crypto | 1:2 |

| Metals | 1:20 |

| Indices | 1:15 |

These ratios encourage stable and risk-controlled trading.

Funding Program Options

Breakthrough Capital offers multiple account evaluation options suited for different trader types.

1-Step Evaluation

| Parameter | Value |

|---|---|

| Profit Target | 10% |

| Daily Drawdown | 4% |

| Total Drawdown | 6% |

| Minimum Trading Days | 5 |

| Leverage | 1:50 |

| Trading Period | Unlimited |

2-Step Evaluation

Phase 1

| Parameter | Value |

|---|---|

| Profit Target | 8% |

| Daily Drawdown | 4% |

| Total Drawdown | 8% |

| Minimum Trading Days | 3 |

| Leverage | 1:100 |

Phase 2

| Parameter | Value |

|---|---|

| Profit Target | 5% |

| Daily Drawdown | 4% |

| Total Drawdown | 8% |

| Minimum Trading Days | 3 |

| Leverage | 1:100 |

Instant Funding

Traders who want to start trading immediately can choose Instant Funding, skipping the evaluation stages.

Funded Account Rules:

| Parameter | Value |

|---|---|

| Profit Split | 60% – 80% |

| Daily Drawdown | 3% |

| Trailing Drawdown | 6% |

| Minimum Trading Days | Unlimited |

| Leverage | 1:100 |

Account Sizes Available

Breakthrough Capital offers multiple account sizes to fit every trader’s goals:

- $5,000

- $10,000

- $25,000

- $50,000

- $100,000

- $200,000

Trading Rules & Restrictions

To maintain a fair trading environment, Breakthrough Capital enforces the following rules:

Prohibited Practices

- Exploiting pricing or platform errors

- Front-running or insider trading

- Hedging within or across accounts

- Using copied or third-party strategies

- Engaging in gambling-style trading (risky, all-in trades)

- News trading (opening/closing trades within 2 minutes of high-impact news)

- Trading more than 200K using the same strategy

- Failing to place a stop loss within 60 seconds of trade entry

Risk Management Rules

- Daily Drawdown: 4%

- Max Total Loss: 8%

- Stop Loss Rule: Must be placed within 60 seconds

- Max Lot Size Rule:

- $5k = 1.75 lots

- $10k = 3.5 lots

- $25k = 7.5 lots

- $50k = 15 lots

- $100k = 30 lots

- $200k = 60 lots

Weekend Trading

Yes — traders are allowed to hold trades over the weekend, giving them flexibility to manage long-term positions.

Account Usage Policy

Trading accounts are for personal use only.

- No third-party management, copy trading, or “pass your challenge” services are allowed.

- Using VPNs or VPS connections that hide your identity may result in account termination.

Restricted Countries

Breakthrough Capital does not accept clients from certain countries due to international regulations.

This ensures compliance with global legal standards and platform safety.

Restricted countries include:

Afghanistan, Belarus, Burundi, Central African Republic, Chad, Democratic Republic of the Congo, Crimea Region, Eritrea, Iran, Iraq, Israel, Cuba, North Korea, Libya, Myanmar, Somalia, Sudan, Russia, South Sudan, Syria, Yemen, Venezuela, and Vietnam.

Pros and Cons of Breakthrough Capital

Pros

- High profit share (up to 100%)

- Clear and transparent rules

- Multiple evaluation models

- Unlimited trading period

Cons

- No EAs or automation allowed

- Moderate leverage

- Restricted countries list

Final Verdict: Should You Join Breakthrough Capital?

Breakthrough Capital is ideal for manual traders who rely on skill, discipline, and consistency rather than automation.

With a 90–100% profit share, transparent rules, and fair drawdown limits, it stands as a solid choice among new prop firms.

If you have a proven strategy and want to scale with funded capital, Breakthrough Capital is definitely worth considering.